Pakistani economist DMKM (he tweets as @2paisay) tries to find out why Erdogan is keeping interest rates low in Turkey. Add your thoughts in the comments. Original article is on his blog here

TL;DR – The answer to the questions posed in the title/subtitle is “I don’t know”.

Someone sent me the below BBC article.

I read the article keenly, hoping to find the answer to the question posed in the title of the report, but I couldn’t. It is a very good question: what is Erdoğan really trying to achieve?

Keeping the interest rate low is severely affecting the Turkish currency. The value of the Turkish Lira has almost halved since Jan 2021. It was around 7 Turkish Lira to a dollar, and now it is almost 14 Turkish Lira to a dollar. That is a huge decline in less than a year.

Turkey’s youth compare their living standards with those in other countries and do not like what they see.

“For a young person in the US or Europe, it’s easy to buy an iPhone with their salary,” says one 18-year-old. “Even if I work for months and months, I cannot afford it. I don’t deserve that.”

This generation is poised to play an important role in politics in Turkey, ruled by Mr Erdogan’s Justice and Development Party (AKP) since 2002.

Almost nine million Turks born since the late 1990s will be eligible to vote in the next election in 2023 and that could spell trouble for the AKP.

What reason does Erdogan provide for the low rates?

Why is the Turkish lira crashing and what impact is the currency crisis having in Turkey? | Euronews

“With the new economic model, we are pushing back the policy of attracting money with high-interest rates. We are supporting production and exports with low interests,” Erdogan said this week.

The Turkish leader has blamed the currency crash on foreign forces bent on destroying Turkey’s economy and says his government is waging “an economic war of independence”.

Erdogan says he hopes volatile Turkish lira will steady soon | Reuters

“God willing we will stabilise all fluctuations in prices and forex rates in not such a long time,” Erdogan told an audience in the eastern city of Siirt.

“Tayyip Erdogan said low interest rates yesterday, says low interest rates today and will say low interest rates tomorrow,” the president said. “I will never compromise on this because interest rates are a malady that make the rich even richer, and the poor even poorer.”

If, like me, you have read Michael Pettis’s writings (disclaimer: this is not what Michael Pettis may have meant in his writings, but this is what I took away from it), Pettis writes that countries like China and Germany, follow mercantilist policies wherein the government uses financial repression to as means of income transfer to the businesses at the expense of the general population. The financial repression can be in the form of providing financing to businesses at subsidized rates and discouraging income increase of the population by not supporting wage increases or devaluing the currency, which makes it hard for the location population to afford imported goods. As the purchasing power of the local population is low, the businesses don’t have an incentive to produce for the local population. This forces them to produce for the export market, resulting in such countries having significant trade surpluses. A devalued currency also means that the labor cost component of the finished goods is smaller in foreign currency terms. This makes exports competitive.

Based on the aforementioned, the low-interest rates should benefit those who have borrowed in the local currency or help the exporters with labor arbitrage, i.e., if the wages of the workers working in the Turkish factories aren’t rising in line with the depreciation of the currency, the labor cost component of the finished goods is shrinking in dollar terms enabling the exporters to export cheaply.

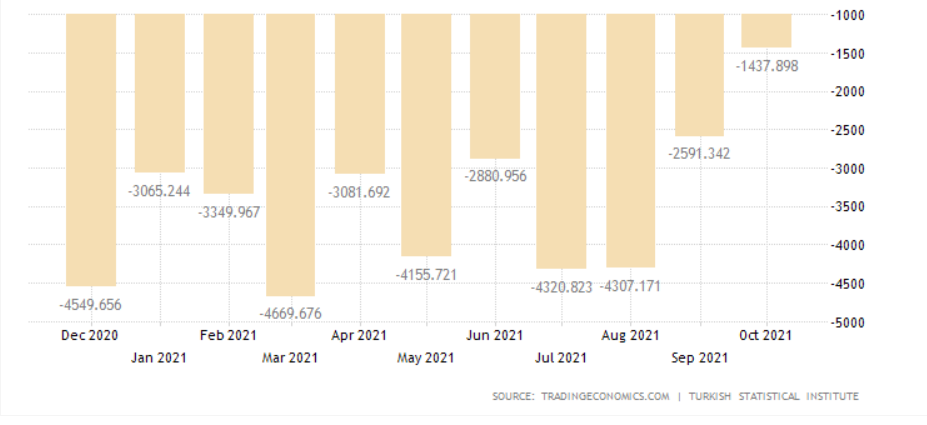

Turkey’s trade deficit narrowed sharply to USD 1.44 billion in October 2021, from USD 2.40 billion in the same period last year. It was the smallest trade gap since November 2018, as exports surged 20.1 percent to a record high of USD 20.79 billion, amid a further global demand recovery and the falling lira. Sales grew for manufactured products (20.3 percent), agricultural goods (12.5 percent), and mining and quarrying (19.9 percent). The main export partner was Germany, followed by the US, the UK, Iraq and Italy. Meanwhile, imports increased at a softer 12.8 percent, due to purchases of intermediate (28.6 percent). Meanwhile, imports fell for consumption goods (-20.4 percent) and capital goods (-25.6 percent). Key import partners were China, Russia, Germany, the US and Italy. Considering January-October, the trade deficit narrowed to USD 33.86 billion from USD 40.28 billion in the same period last year

It appears that devaluation has helped with the exports, with sales of manufacturing goods increasing by 20%. In addition, import of consumption goods has decreased by 20%, a success of the strategy if that was the goal. On the flip side, a 25% reduction in capital goods import portends future industrial capacity.

But the above didn’t last long. The continued weakness in Lira and rising commodity prices aren’t helping close the trade deficit.

Turkish Trade Deficit Widens in November on Commodity Rally – BNN Bloomberg

Turkey’s trade deficit widened in November as the rally in commodity prices pushed imports higher, according to preliminary data by the country’s Ministry of Trade on Thursday.

The gap expanded 5.4% from year earlier to $5.33 billion last month, while imports rose 26.7% to $26.7 billion and exports surged 33.4% to $21.5 billion.

Early data show weakness in the lira — which lost more than a quarter of its value last month — has done little to balance Turkey’s foreign trade in goods.

Below are some of the highlights from trade data:

- Imports of mineral oils — an indicator of Turkey’s energy bill — stood at $6.5 billion in November, up 155.5% from a year earlier, highlighting the risks to Turkey’s foreign imbalances from rising oil and natural gas prices

- Steel and iron imports rose 75.3% to $2.55 billion during the same period, showing the impact from a broad-based rally in commodity prices as global vaccine roll out fueled world economic growth

- On the other hand, supply bottlenecks slowed growth in some of the key export sectors, such as cars where shipments abroad fell 9% to $2.16 billion.

Construction is also one of the favored sectors of Erdoğan as they have really thrived under his rule, with Turkey undertaking major construction and development projects.

Lira’s tumble hits hard Turkey’s key construction sector: industry professionals – Xinhua (news.cn)

The sector, which accounts for about six percent of the overall gross domestic product (GDP) and employs nearly 2 million people, was recovering from a currency crisis in 2018 before the fallout of the COVID-19 pandemic dragged it back into the troubled waters in late summer when the Turkish lira accentuated its decline against the U.S. dollar.

“We are in dire straits. The prices of building properties and imported raw materials have skyrocketed in the past few months because of the devaluation of the lira,” Engin Atay, a contractor based in the capital Ankara, told Xinhua.

“The depreciation is so significant that projects in big cities such as Istanbul or Ankara have come to a standstill. In the current situation, it is impossible to engage in new construction,” he said.

…the work has halted since September at numerous construction sites across Turkey as contractors staged a two-week protest against soaring cement prices.

“Material prices have gone through the roof. The price of cement, ready-mixed concrete, sand, and steel has increased on a weekly even daily basis. Our business is reeling from this currency turmoil,” Koray Sert, co-owner of a building materials company, told Xinhua.

Despite appearances to the contrary, the low interest rate policy will not be due to Erodgan’s distaste for interest on account of his religious beliefs. Having ruled the country for 19 years and overseen economic growth in his electoral base funded by local and international borrowings, he knows that interest greases the wheels of commerce. If he displays a disgust for interest, in my opinion, it is a charade.

The low interest rate

- is resulting in fall of Lira which is adding to the imported inflation,

- isn’t helping close down the trade deficit,

- isn’t benefiting the construction sector,

- is causing restiveness in the youth as they can’t afford phones from their salaries,

- is resulting in annual inflation of 20%+ which is affecting wide swathes of society including, I believe, the middle class and medium-sized businesses, which form the bedrock of his constituency,

- and, in my opinion, isn’t a result of Erdogan’s religious beliefs.

This makes the question even more pertinent that why is Erdoğan sticking with low interest rates despite the advice of his central bankers to the contrary (he has fired quite a few central bank officials) ? One can hazard a few guesses, but they are akin to shooting in the dark.

- He and/or his friends have businesses that are heavily leveraged with local borrowing.

- His distaste for high interest rates.

- His astrologer advised him, or he had a dream in which he was instructed to keep the interest rates low.

Still doesn’t explain that why the Turks aren’t out in the street protesting against this. Is it because they think there is no other option than Erdoğan?

I liked this anecdote in the BBC article

One video that went viral showed a mother praising President Erdogan to a reporter, while her eight-year-old son contradicted her, pointing out his poor handling of recent disasters.

Bottom line: From the quick googling, I was not able to reach a conclusion why Erdoğan wants to maintain low interest-rates.

I have also read Michael Pettis and it is correct that he advocates for developing countries to retain a “competitive exchange rate” as he calls it. Similar arguments have been made by Ha-Joon Chang. Pettis is an opponent of Germany using it, since it’s obviously an advanced country.

The reason why it doesn’t work for Turkey is that it is a country that has run massive current account deficits for most of its modern history. The fundamental problem is low productivity which in turn is a symptom of low human capital.

East Asian countries did well by suppressing their exchange rates because they were brutally competitive, in large part because they had very high human capital even when poor. East Asian countries also ran very high savings rates, which allowed them finance all investments domestically without relying on foreigners.

All these things are laid out in Chang’s books (he is Korean himself, despite the Chinese surname). I think the author is confused because he has been marinated in Western neoliberal theory. But the West itself had policies very similar to what I described above. They simply don’t advocate it to developing countries as a classic “do as I say, not as I do”, because the West controls financial markets and thus profits when poor countries run large and consistent current account deficits, because they have to be financed from abroad and that means the West.

When said countries are inevitably thrown into crisis, Western institutions like the IMF are brought in and can make punishing demands, often linked with US political objectives. This is what Pakistan is now seeing.

There’s a term for this: imperialism. But too many economists are terrified of talking politics, even if the two subjects are completely interrelated.

Lot of similarities b/w Turkey -Pakistan.

Good military with not so good economy, punches above its weight. Plus simping for western validation till the last decade.

He could also literally believe keeping interest rates low will reduce inflation. I doubt it, but maybe he doesn’t realize his central bank lowers interest rates by printing more money. Smarter people have believed the same.

https://www.google.com/search?q=Neo-Fisherianism&oq=neo-fi&aqs=chrome.0.69i59j69i57j46i512j0i512l2j69i60l3.2135j0j4&sourceid=chrome&ie=UTF-8

The strategy of limiting imports and boosting exports through competitive devaluation works when done within a limit. Countries like China, Japan and Korea try to keep the value of their currency about 10 to 30% lower than equilibrium prices.

What has happened to Lira is basically CRAZY. The lira has declined in value by over 300% in a span of three years. This is bound to mess literally everything up. Turkey is not like Russia or United States where it IS possible to have an autarkic experiment (thanks to natural resources). It NEEDS to import raw materials if nothing else. So letting Lira slide like this is deeply irresponsible.

Erdogan went on a huge debt binge to build infrastructure and has turned the country into a basket case. Keeping interest rates low is how he is hoping to avoid a reckoning with reality. It is excellent if you are planning to go on vacation there, it can be ridiculously cheap for meals etc.